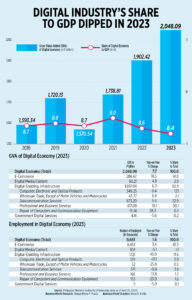

In a meeting among economists in a foreign embassy, former Bangko Sentral ng Pilipinas (BSP) Governor Felipe Medalla expressed his concern that the Philippines lacks a growth driver that it had in the past years with the business process outsourcing (BPO) industry. BPO revenues went from a few million in 1992 to $35 billion last year, contributing greatly to dollar revenue and GDP growth.

What could the next growth drivers be?

Mining is one candidate. It’s often mentioned considering the world’s need for critical minerals like copper, nickel, and lithium in the green transition to EVs (electric vehicles). The Philippines is one of the most mineralized countries in the world. As one Australian government paper noted, “The Philippines is one of the world’s most richly endowed mineral resources countries. It is estimated to have about $1 trillion worth of untapped copper, gold, nickel, zinc, and silver reserves. Only 5% of these reserves have been explored, and 3% are covered by mining contracts.”

The country still has a long way to go to fully exploit its mining potential. There are many noisy opponents to mining, from the Catholic clergy to environmentalists, leftists, and even LGU executives who believe they aren’t getting a fair share of the mining firms’ revenues.

The uncertain tax environment is also a deterrent to mining investment. The Department of Finance has recently come out with a mining tax proposal that will enable the government to get its fair share of revenues, based on profitability or net margin. If passed, the mining tax bill can give some certainty to potential investors and help lure more investments in mining.

Also, it’s unfortunate that exploitation of natural resources was left out in Congress’ resolution to remove foreign ownership restrictions in the Constitution. Mining is capital-intensive and there’s just not enough Filipino capital to exploit our abundant mineral resources.

Tourism is another candidate. We have had problems promoting tourism even though our beaches, mountains, and other natural wonders are far superior to those of Thailand. Lack of infrastructure, peace and order, poor healthcare facilities, and shenanigans by Immigration and airport personnel in our airports have discouraged more tourists from coming in. We don’t even have a world-class arena to host a Taylor Swift concert even if she could come. The Philippine Arena is a traffic magnet during concerts — just ask those who attended the Cold Play concert.

However, there is hope. NAIA will be handed over to a private operator at last and San Miguel Corp. has promised to modernize it even as it’s building a bigger one in Bulacan. Clark International Airport can easily expand and will be connected by railway to Metro Manila by 2028.

With the right policy mix and infrastructure investments, tourism can replace BPOs as a growth driver and dollar earner.

I have always been a booster of the forestry industry. The Philippines has a comparative advantage in forestry because it’s in a tropical zone. The Philippines can produce 100 cubic meters of timber per hectare compared to countries in the temperate zone like Finland where the output is anywhere from five to 15 cubic meters per hectare. Experts figure that the forestry industry can contribute as much as 2% of GDP. (In Finland, it’s 8%.)

Forest production or tree farming has enormous potential benefits, not just to the furniture and wood industries, but to climate change mitigation, energy production, water management, agriculture, carbon capture, and so many more. It will even boost tourism because forest trekking and forest bathing can be promoted as part of adventure tourism.

However, the potential of the forestry industry can be realized only when investors in tree plantations are given secure property rights because it takes so long to grow a tree to maturity (the earliest would be 13 years for fast-growing species). In some cases, especially for hardwood, it takes around 20 years, by which time, a concession agreement under the present rules would expire. The present rules only allow for 25 years, extendible for another 25 years, but the investor is at the mercy of the Department of Environment and Natural Resources.

This is why the Foundation for Economic Freedom is proposing a bill that would: a.) define planted trees as personal property. In other words, the law will treat planted trees like any other commercial crop, such as cabbage or potato. This will exempt tree farms from arbitrary log bans, allow foreigners to invest, and make them bankable; and, b.) consider trees as renewable resources, and not depletable natural resources. Since planted trees are not natural resources, these would exempt them from the 25-year rule.

Another growth driver could be defense industries because geopolitics is presenting the Philippines with an opportunity to develop Philippine-based defense industries. Japan, for example, would be doubling its defense spending in the next few years. Europe and the US are also hiking defense spending. We could present ourselves as part of the secure and friendly supply chain to our allies’ defense requirements, from supplying semiconductors for drones to uniforms.

Cultural and service exports could be another winner. However, in excluding mass media and the practice of professions in the liberalization of foreign ownership restrictions in the Constitution, Congress may have handicapped our ability to do cultural and service exports.

We could be exporting culture or soft power like what South Korea is doing. After all, we have much better singers, dancers, musicians, and the like. However, access to capital and technology is critical. We can’t access foreign capital to develop our cultural industries because investment in those industries could be interpreted as a violation of the Constitution.

We could also be exporting services, from healthcare to engineering. However, access again to capital and technology is constrained by the Constitution, which limits the practice of professions to Filipino citizens. Just getting a foreign faculty member to teach in a local university requires so many permissions. We need to open ourselves up to global talent if we are to export services. The US can “export” the NBA because the latter welcomes talent from anywhere in the world, whether Greece (Giannis Antetokounmpo), Serbia (Nikola Jokic), or China (Yao Ming).

There can be no shortage of growth drivers for the Philippine economy, given political will and the removal of binding constraints. Even agriculture, which contributes a mere 10% to GDP, can become a growth driver if the binding constraints of land fragmentation and agricultural protectionism are seriously tackled. Unfortunately, agriculture is one area where the administration is failing to address binding constraints.

Overall, the administration is moving in the right direction by promoting investments through liberalizing foreign investment restrictions and increasing access to markets (RCEP, Free Trade Agreements or FTAs with South Korea, and possibly Canada and the EU.) A more investment-friendly climate would drive investments in these growth sectors.

Calixto V. Chikiamco is a board director of the Institute for Development and Econometric Analysis.