YIELDS on government securities (GS) ended mostly higher last week as investors took positions in anticipation of supply pressure from upcoming bond issuances.

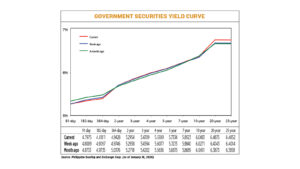

GS yields, which move opposite to prices, went up by an average of 1.48 basis points (bps) week on week, based on the PHP Bloomberg Valuation Service (BVAL) Reference Rates as of Jan. 16 published on the Philippine Dealing System’s website.

At the short end of the curve, rates went down across the board. The 91-, 182- and 364-day Treasury bills (T-bill) dropped by 0.34 bp (to 4.7975%), 2.86 bps (4.8811%), and 3.18 bps (4.9428%), respectively.

Meanwhile, all yields at the belly and the long end ended higher week on week. Rates of the two-, three-, four-, five-, and seven-year Treasury bonds (T-bonds) rose by 0.16 bp (to 5.2954%), 1.15 bps (5.4709%), 1.12 bps (5.6189%), 0.61 bp (5.7334%) and 0.83 bp (5.8923%), respectively.

The 10-, 20-, and 25-year bonds also went up by 2.12 bps, 8.32 bps and 8.38 bps to yield 6.0483%, 6.4875% and 6.4852, respectively.

GS volume traded amounted to P71.97 billion on Friday, higher than the P55.42 billion recorded a week earlier.

“The upward drift in yields was driven largely by de-risking toward the latter part of the week as investors positioned ahead of the upcoming bond auctions scheduled through the end of January, which are concentrated in the longer segments of the curve. With supply pressure building on the long end, investors took a more cautious stance, prompting yields to inch higher,” ATRAM Trust Corp. Chief Investment Officer Alessandra P. Araullo said in a Viber message. “Global cues played a minimal role as local markets mainly responded to supply expectations rather than external macro drivers.”

On Tuesday (Jan. 20), the Bureau of the Treasury (BTr) will auction off P30 billion in reissued 20-year bonds with a remaining life of seven years and two months.

It will also hold a dual-tranche bond auction on Jan. 27, where it will offer reissued three- and 20-year debt.

Ms. Araullo said the market focused on the upcoming issuances amid a lack of fresh leads.

“At this stage, inflation is no longer the primary driver of yield movements. While past CPI (consumer price index) readings provided initial direction, the market has now shifted its focus toward bond supply and auction outcomes… With no fresh catalysts on the local macro front, inflation has taken a back seat; the market is instead positioning for how upcoming issuances will be received.”

Rate cut expectations for the Bangko Sentral ng Pilipinas (BSP) following the below-target 2025 Philippine CPI data released earlier this month caused a slight decline in GS yields early on, but inflation risks for this year also capped the downside, a bond trader said in a Viber message.

“The movers [last] week were mainly from delayed data releases from the US. Both softer US inflation reports with a strong bump in US retail sales underscored the strength of US consumption spending, which solidified views that the Federal Reserve might not need to deliver a rate cut by the end of the month,” the trader added.

US data last week showed inflation pressures were stable in December, but consumers faced higher food prices and rents, Reuters reported.

Though economists expect the Fed will keep its benchmark overnight interest rate in the 3.5%-3.75% range at its Jan. 27-28 meeting, reductions in borrowing costs are anticipated this year to safeguard the labor market.

Economists expect the government to report next Thursday that the personal consumption expenditures (PCE) price index, excluding the volatile food and energy components, increased 0.2% in November, matching the estimate for October. The PCE inflation data, tracked by the Fed for its 2% inflation target, was delayed by the 43-day federal government shutdown.

For this week, the bond trader said GS yields may continue to be range-bound.

“Despite the expected release of PCE inflation and US GDP reports [this] week, yields might move sideways with some downward pressure as the latest economic data from the US and the Philippines are unlikely to change current market expectations for both the Fed and the BSP moves just yet,” the trader said.

Ms. Araullo said yield movements will be largely driven by the results of the BTr’s bond auctions. “With the upcoming issuances concentrated in the longer parts of the curve, investor demand will determine whether yields continue to edge higher or stabilize,” she said. “If the auctions attract strong bidding, this could support buying momentum and help cap or even reverse the recent uptick in yields.”

“However, weak demand — especially for longer-dated bonds that carry heavier supply — could limit bond rallies and keep upward pressure on yields. Given the absence of major local catalysts, the market will be taking its cues primarily from these auctions. Supply dynamics will guide investor behavior across tenors, and the tone set by the first rounds of bidding will likely influence sentiment for the rest of January.” — Lourdes O. Pilar with Reuters