Negros Island is rewriting its economic story. Once known as the country’s sugar bowl, the newly reestablished Negros Island Region (NIR) is emerging as the Visayas’ renewable energy capital, capturing nearly half of all approved investments in the second quarter (Q2) of 2024.

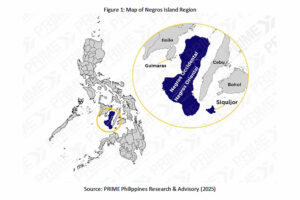

For decades, residents of Negros Occidental and Negros Oriental were compelled to travel to Iloilo or Cebu for regional government services due to the island’s segregation between Western and Central Visayas. To address this, President Ferdinand R. Marcos, Jr. in 2024 officially reestablished the NIR and fulfilling a long-standing aspiration of Negrenses. Unlike previous executive attempts, RA 12000 provides a stronger legal and administrative framework, enabling full decentralization of government functions and streamlined inter-agency coordination across Negros Island and Siquijor. The unified regional administration is designed to accelerate investment, stimulate economic growth, and enhance regional competitiveness by harnessing the island’s full potential.

Prior to the creation of the Negros Island Region, Negros Occidental residents were included in Western Visayas, while Negros Oriental and Siquijor residents were included in Central Visayas. In the 2024 census, the exclusion of these provinces resulted in a notable population decline in Central Visayas (-3.9%) and Western Visayas (-1.8%), impacting on the regional demographic profiles and planning considerations.

Beyond the political symbolism, the impact is already visible on the ground. From billion-peso solar farms and biomass facilities fueling the energy grid, to Bacolod’s growing role as a logistics and outsourcing hub, Negros is positioning itself as one of the most dynamic growth centers in the Visayas. This is a clear shift that signals both opportunity and challenge for investors.

AGRICULTURE POWERS NIR’S TRANSITION INTO A DYNAMIC AGRO-INDUSTRIAL AND RENEWABLE ENERGY POWERHOUSENIR’s strong agricultural base makes it a hub for agribusiness and value-added industries, fueling demand for logistics and infrastructure expansion. In 2024, the Agriculture, Forestry, and Fishing (AFF) sector generated P83.39 billion, ranking second in the Visayas. Negros Occidental, known as the “Sugar bowl of the Philippines,” also accounts for more than half of national sugar production, supported by 13 sugar mills and six refineries, including Victorias Milling the largest integrated mill and refinery in the country.

Sugar by-products, particularly bagasse and cane trash, have become critical inputs for renewable energy. Biomass facilities now form a cornerstone of the island’s power mix, contributing to the fact that 99.1% of Negros Occidental’s electricity production comes from renewable sources.

The clean energy transition has also reshaped the investment landscape. In Q2 2024, NIR secured P86.5 billion in approved foreign investments, equivalent to 45.6% of the national total, with the bulk directed toward renewable energy. Furthermore, other key projects include AboitizPower’s 173-MWp Calatrava solar farm, Citicore’s 100-MWp Silay facility, and the P6.9-billion Bacolod-Bago solar plant (150 MWp) slated for completion in 2025. In total, more than 1,000 MW of renewable capacity is in the Department of Energy (DoE) pipeline for Negros.

COST COMPETITIVENESS AND NEW INFRASTRUCTURE FUEL BACOLOD’S WAREHOUSING GROWTHBuilding on this agricultural and green foundation, the NIR is also seeing steady growth in industrial and logistics activity, particularly in Bacolod City. Demand is driven by its proximity to ports, airports, and major urban centers. Most occupiers are engaged in logistics, distribution, and personal storage, with rising interest from FMCG firms targeting the local consumer market.

At the heart of this activity is the Bacolod Real Estate Development Corp. (BREDCO) port, which serves as the city’s logistics backbone and is evolving into a warehousing hub, with facilities ranging from 1,700 to 5,000 sq.m. While flooding challenges persist within the port area, adjacent sites offer room for expansion that supports sustained growth.

The Negros Island Region accounted for 61% of total shipcalls in the Visayas, underscoring its pivotal role in regional maritime activity. Within the region, Panay/Guimaras recorded 91,337 shipcalls, significantly higher than Cebu’s 39,576, and among the highest compared to major ports in Luzon and Mindanao. In terms of cargo movement, the region handled 37% of the Visayas’ total volume, with Panay/Guimaras emerging as the top contributor in the NIR and the second highest across the Visayas.

The reestablishment of the Negros Island Region presents an opportunity to strengthen logistics and inter-island connectivity, particularly as Negros Occidental accounts for most of the country’s sugarcane output. However, the region’s dependence on sugar leaves it vulnerable to climate risks and price volatility. Thus, the diversification to other industries and services as mentioned above is crucial in sustaining the growth of NIR.

Bacolod also enjoys a cost advantage. Warehouse rental rates range from P150-250 per sq.m. per month, at par with Iloilo and below Cebu’s P185-300, giving the city a competitive edge for occupiers. Looking ahead, strategic infrastructure projects such as the Bacolod–Negros Occidental Economic Highway, the New Dumaguete Airport in Bacong, and the Panay–Guimaras–Negros Island Bridges are poised to enhance connectivity across key gateways. These include the established BREDCO and Dumaguete Ports as well as the Bacolod–Silay and Sibulan Airports, with the upcoming Bacong Airport expected to significantly boost trade and regional integration.

EMERGING OPPORTUNITIES POSITION BACOLOD AS THE NEXT BPO FRONTIERBacolod City’s office market is gaining traction, driven by the expansion of the BPO sector. Recognized as a “Center of Excellence” for IT-BPM and one of the country’s “Next Wave Cities,” the industry employs about 40% of the city’s white-collar workforce, underscoring both its reliance on outsourcing and the sector’s confidence in Bacolod as an alternative to Cebu and Metro Manila.

In the first half of 2025, Bacolod’s office occupancy dipped below 80% due to new stock in the market. The flip-side of the market is that it gives ample room for new entrants and providing occupiers with greater leverage in negotiations. Rental rates average P500-800 per sq.m., comparable to Cebu but well below Metro Manila’s P900-1,100, making Bacolod a cost-efficient option for firms seeking scalability without compromising talent access. This is supported by a steady pipeline of over 20,000 college graduates annually and lower operating costs than in Metro Manila.

Developers are reinforcing this momentum. Megaworld’s Upper East Township delivered Bacolod’s first LEED-certified office building and, in June 2025, became the city’s first PEZA-accredited IT Park, with a second tower underway. Other major developers such as Ayala Land and Robinsons Land also have their respective mixed-use developments in the city.

While Bacolod is gaining ground, its office market will reach its potential only if key hurdles are cleared. Foremost is the difficulty local developers face in securing PEZA accreditation, which limits the supply of fiscally incentivized space that outsourcing firms prioritize when choosing sites. By contrast, Cebu hosts dozens of PEZA-accredited buildings, and Iloilo’s accredited stock is clustered in Iloilo Business Park.

NIR ADVANCES ITS POSITION AS A KEY REGIONAL GROWTH CENTERAnchored by agriculture, fueled by renewable energy, and supported by competitive industrial and office markets, the Negros Island Region is steadily transforming into a diversified investment hub. This convergence signals its evolution from a traditional agricultural economy into a dynamic center for industry, services, and sustainable growth, firmly positioning it as one of the most promising emerging markets in the Visayas.

Jet Yu is the founder and chief executive officer of PRIME Philippines, a commercial real estate advisory firm.