Self-employed workers and landlords earning over £50,000 a year will face fines of up to £900 if they miss new quarterly tax deadlines under HMRC’s Making Tax Digital reforms. The changes, due from April 2026, will replace the traditional annual self-assessment return with a digital reporting

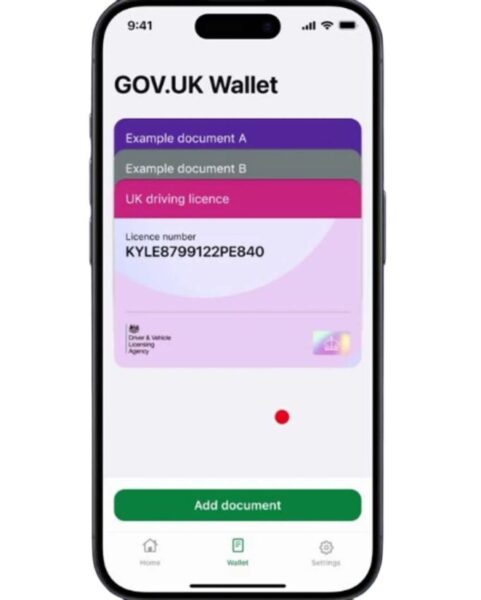

Tens of millions of UK motorists will be able to access a digital version of their driving licence by the end of 2025, as the DVLA accelerates plans to digitise services through the new GOV.UK Wallet and app. The move, part of Labour’s £45 billion strategy

Chancellor Rachel Reeves is facing claims she “massively underestimated” the extent to which parents of private school pupils would prepay fees to avoid her VAT levy. Figures suggest the top 50 independent schools received £515 million in advance fees before the 20% VAT charge came into

If you work in estate agency, you’re not new to regulation and compliance. They’re just a normal and everyday part of running your business. From AML checks to GDPR obligations and even property misdescription legislation, there’s a lot to keep on top of. But while they

For years, digital currency was seen as the wild west of finance—volatile, complex, and suitable only for high-risk investors or tech obsessives. But times have changed. As crypto infrastructure matures and major businesses dabble in blockchain, a new idea is gaining traction: payroll in crypto. Could

As of 2025, the Financial Conduct Authority (FCA) has introduced new changes as to how the UK mortgage market is monitored. This is part of a wider effort that is aimed at improving the level of transparency and support for vulnerable borrowers and to make sure

Fast replies are no longer impressive; they’re somewhat expected. Whether it’s a live chat, an abandoned cart email, or a follow-up message, the speed and consistency of communication can make or break the business-to-customer relationship. Businesses juggling multiple platforms and growing customer bases are realising that

The Ivy is facing a legal battle with a former waiter who claims the upmarket restaurant chain unfairly allocated him a share of tips and service charges – and refused to explain how his portion was calculated – despite a new law requiring fair and