Last week, on Aug. 27, Meralco opened the bid documents given by six bidders for its 600-MW competitive selection process (CSP) for baseload capacity. The winners were SMC’s Masinloc Power for 500 MW and Aboitiz Power’s GNPD for 100 MW with all-in rates of P5.60/kWh and P5.74/kWh, respectively. Both are coal plants, and they can again deliver cheap electricity below Meralco’s reserved price for levelized cost of electricity (LCOE) set at P7.26/kWh. The consumers win, they are protected from higher prices by other bidders.

Jose Ronald Valles, Meralco Senior Vice-President and Regulatory Management Head, said in a press statement that “The main objective of the CSP, which is to secure the least cost supply for our customers, has been achieved. We hope that there will be no further delays as we work towards immediate signing of the PSAs (power supply agreements) resulting from the 600-MW CSP. We trust that ERC (Energy Regulatory Commission) evaluation and approval will also be swift so customers can enjoy these very low rates upon scheduled delivery date in August 2025.”

I hope there will be no temporary restraining order (TRO) from any court, an ugly business strategy resorted to by losing companies who cannot provide cheap energy to the consumers. BusinessWorld reported on the concluded CSP for 600 MW and the forthcoming 400 MW: “Meralco: SMC, Aboitiz units offer lowest rates for 600-MW supply” (Aug. 28), and “Six firms eye Meralco’s 400-MW contract” (Aug. 30).

Some left-leaning groups made noise as usual. Bayan Muna leader Carlos Zarate, for example, criticized the outcome of the Meralco CSP because “dirty coal wins.” These people have poor comprehension of energy economics, for three reasons.

First, a CSP is about price selection (the lowest), not climate or environmental selection, not imported vs domestic gas selection. Secondly, cheaper electricity is pro-people and pro-consumer, and real NGOs should praise it. Only fake NGOs will attack it. And third, the dirtiest energy is not coal but candles, kerosene torch, and diesel gensets for lighting, and animal dung or firewood for cooking.

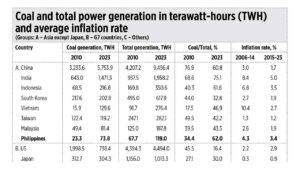

Countries with high coal consumption tend to have lower inflation than countries with declining coal use. The clearest examples are Asian countries, like China whose coal generation went from 3,234 terawatt-hours (TWh) in 2010 to 5,754 TWh in 2023, and whose average inflation rate of 3% in 2006-2014 went down to 1.7% in 2015-2023. India, Indonesia, Vietnam, and other Asian nations exhibited the same trend.

In contrast, the G7 industrial, decarbonization- and net zero-obsessed countries have had a decline in coal use and rising inflation rates over the same period. Outside the G7, Russia, South Africa, and Australia also showed the same trend as the Asian nations (see the table).

There are many other factors why the inflation rate is rising or falling in certain countries and the energy technology being used is only one of them. But the use of cheap, reliable, and higher energy dense coal (and gas and nuclear power) than intermittent renewables is an important factor that contributes to lower inflation.

The result of the Meralco CSP for 600-MW baseload is consistent with the desire of most Filipinos who look at high inflation as their number one concern — also consistent with a global trend that high coal-using countries have declining consumer prices.

Last week I attended the American Chamber of Commerce of the Philippines (AmCham) 7th Annual Energy Forum held at Marriott Manila with the theme, “Powering an Efficient and Progressive Future in the Philippine Energy Industry.” The keynote speakers were Senators Mark Villar and Sherwin Gatchalian (who gave a virtual speech), Congressman Mark Cojuangco, ERC Chairperson Monalisa Dimalanta, and the President of the Independent Electricity Market Operator of the Philippines (IEMOP) Richard Nethercott.

Among the familiar faces I saw there were Eleonore C. Rupprecht and Guy Boileau, Counsellors and Trade Commissioners of the Canadian Embassy. The embassy organized the Philippines Nuclear Trade Mission to Canada last March of which I was one of the participants, along with Ms. Dimalanta, Energy and Science officials, local media and local energy companies.

In the morning panel session, “Energy Supply Mix: Updates, Challenges, and Opportunities on the Non-renewable Energy Sector in the Philippines,” I liked the position on energy security stated by Don Paulino, Chief Engineering and Projects Officer of AboitizPower Thermal Group. He said that while they aim for 50% of their portfolio to be renewable, they also “want a stable, affordable, and sustainable baseload, which can support the intermittency of our renewable sector, that our current baseload is running efficiently so that we can have stable power whilst waiting for the newer technologies. We’ve seen it in the grid, if a large power plant trips, you can see the spike in prices.”

The Executive Director of the Philippine Nuclear Research Institute (PNRI), Dr. Caloy Arcilla, was also on the same panel and he correctly pointed out the need for nuclear power to be in the country’s energy mix because it is cheap, stable, and safe. Mr. Cojuangco in his speech argued for large nuclear plants with a capacity of 16,000 MW by 2045.

In the afternoon panel session on renewable energy and energy efficiency, I like the point made by Meralco Chief Operating Officer Ronnie Aperocho who said that they are going to nuclear energy to help strengthen the country’s energy security. On the speakers pushing for offshore wind, I do not believe that this energy source can deliver cheap electricity without heavy subsidies — aside from spoiling the beauty of the open sea with those tall industrial wind towers.

Meanwhile, the ERC issued the “Omnibus Rules on Consumer Choice Programs in the Retail Electricity Market” on Aug. 14. The rules include a limitation for retail electricity suppliers (RES) to contract only up to 50% of their power needs from affiliate generation companies (gencos). I think this is wrong because RES customers constitute a competitive market, not a captive market. Customers are better protected when the RES is genco-owned because it does not rely on outside purchased power and can withstand price spikes and still serve their customers.

Bienvenido S. Oplas, Jr. is the president of Bienvenido S. Oplas, Jr. Research Consultancy Services, and Minimal Government Thinkers. He is an international fellow of the Tholos Foundation.